Forex (Foreign Exchange)

Forex market (short for “foreign exchange”) is the largest and the most liquid financial market where the global currencies are traded. Forex traders purchase currencies with the intent to make money off of the difference between the buying and the selling prices. The foreign exchange market, also known as FX or Forex trading, is one the most fast paced, dynamic markets in the world. Traditionally, huge global financial institutions, central banks, hedge funds, and the super-rich dominated the Forex trading market.

Learn Understand TradeAll of this changed with the arrival of the internet. Now there are no barriers preventing anyone from Forex trading. It is completely accessible to most investors, and you can buy and sell international currencies at the click of a mouse from your own home. Currency is similar to language, in that it varies from country to country. If you want to do international business or buy goods from abroad, you must pay with the local currency. The FOREX investment package is a unique product that allows investors to earn without having to actually trade Forex themselves. For instance, you wouldn’t expect to use Swiss Francs to pay for your meal in Marrakech, which is exactly where Forex trading comes in. Global currencies are traded on the foreign exchange market. Comparing this market to the stock market is one way to grasp the sheer scale of it; the average traded value of the global stock market is around $2,000 billion per day, while Forex trading surpasses $4.9 trillion daily. Unlike some other markets, this is no central market for Forex trading. Currency trading is all done over the counter electronically on global computer networks between individual traders. There are five major Forex trading centers: Frankfurt, Hong Kong, London, New York and Tokyo. The Forex market is open 24 hours a day, five and a half days a week, and operates across nearly every time zone, which makes for an active market in a continual state of flux, with prices changing all the time. When currencies are traded on the Forex market, they are bought and sold in what are known as currency pairs, where one currency is used to buy another. These pairs have been created to make comparing currencies easier, and as a way to better understand the value of one in relation to the other. The EUR/USD pairing is among the most popular. In currency pairs, the first currency is the base and the second currency is referred to as the counter currency. So in the previous example, you are using USD to buy EUR. Your broker converts your existing currency into USD, and then uses that to buy EUR. When buying a currency pairing, you take what is known as a ‘long position’, and when selling you take a ‘short position’. It is vital that you have a good understanding of the current climate of your chosen currency market. If you believe people are going to sell bitcoin, for example, then this will bring the price down in relation to the EUR. We provide regularly updated information on many popular pairings, and we include the popular Bitcoin cryptocurrency in our currency index. The majority of Forex traders focus on the following currency pairs: EUR/USD, USD/JPY, GBP/USD, and USD/CHF are the main four, followed by USD/CAD, AUD/USD and NZD/USD. All other pairs are just different combinations of the same currencies. . You can invest in the Forex investment pacakge, IQpickstrade will receive a percentage of the profits they earn from trading with your funds as a commission.

The FOREX service has been one of the most in-demand financial instruments in 2013 with a turnover of over $92Bn during the first nine months of the year. IQpickstrade continues to improve and refine the service, striving to make it as transparent and understandable as possible for customers. As part of the next stage of operations, the FOREX account rating formula has been upgraded.

The method used to calculate the growth rate for a specific period has been updated in order to exclude being placed in the top rating of FOREX accounts that have not been traded for a long time. Now, the final calculation of positive growth for a specific period will not include data for the most recent period:

- An annual calculation will not include the last quarter

- A six-month or quarterly calculation will not include the last month

- A monthly calculation will not include the last week

The history of copy trading goes back to 2005 when traders used to copy specific algorithms that were developed through automated trading. Brokers recognised the potential of having systems where any linked to that trader could automatically copy their trading account. There was no need to constantly monitor email signals or trading ‘chat’ rooms. We think they were onto something. Out of this were born services that allowed traders to connect their personal trading accounts to their platform. Traders no longer had to submit their specific strategies. The popularity of copy trading has since exploded.

1 in 3 say a traditional stock market approach is over-complex and this can be simplified by automatically following traders. 1 in 4 investors said they were considering Copy trading last year

So How Does It Work?

Here is how the copier works: You, as an investor, simply select an expert or experts that you want to copy trades from. Once you are signed up, this is the only action needed on your part.

Once you’ve taken care of the above, you are all set. There are no codes that you need to run or signals for you to manually input. Our software will handle the trade copying automatically on your behalf. We monitor your experts trading activity and as soon as there is a trade, we calculate all the necessary parameters and execute the trade.

The only thing you have to make sure of is that you have enough funds available in your trading account. When the expert exits a position, you too will exit it. Automatically.

We carefully select expert applicants. We get to know them as a trader and examine their trading performance over a period of time. We also tend to look for expert who already have a following to further confirm their competence (social proof). You can also read about every expert on their individual performance pages.

The copier works based on trade percent amount. So, for example, if your expert takes a position in XYZ coin for a total of 10% of his account value and you are 100% allocated to that expert, then the copier will also execute a trade in your account in the amount of 10% of your account value.

The only thing you have to make sure of is that you have enough available base currency that your expert trades with, in your trading account. How much is enough? First, you must meet the exchanges minimum order amount (let’s say about $10 per trade to be safe). That means that if your expert executes a 5% order, you must have at least $300 in your account total value (at 100% expert allocation as an example). This also means that you need to have at least 10% or higher in available base currency to avoid missed trades.

When the expert exits a position, you too will exit it. Automatically. You can also change allocation at any time.

Return

The potential of the Forex market is unlitmited. You can earn high returns by investing in a FOREX investment package without being skilled at trading.

Transparency

The FOREX service has undergone a compliance check by an international auditing firm. You can see the results of the audit for yourself in your IQpickstrade investor dashboard.

Control

You can withdraw your profits, or all of your funds, at any moment via your IQpickstrade Capital Group investor dashboard. You can also spread your risks by investing in several different FOREX investment packages.

As A Leading Global Asset Manager We Are Dedicated To Creating Long Term Value For Our Clients.

Aligning our brand with those who share our values and ambition helps us to strengthen and build our business around the world. It is also one of the ways that we are able to support the communities in which we operate. Our partnerships reflect our belief in continuous development, performance and sustainable growth – and we aim to inspire excellence in whatever we put our name to.

Lucrative Investment Opportunity At Your Fingertips.

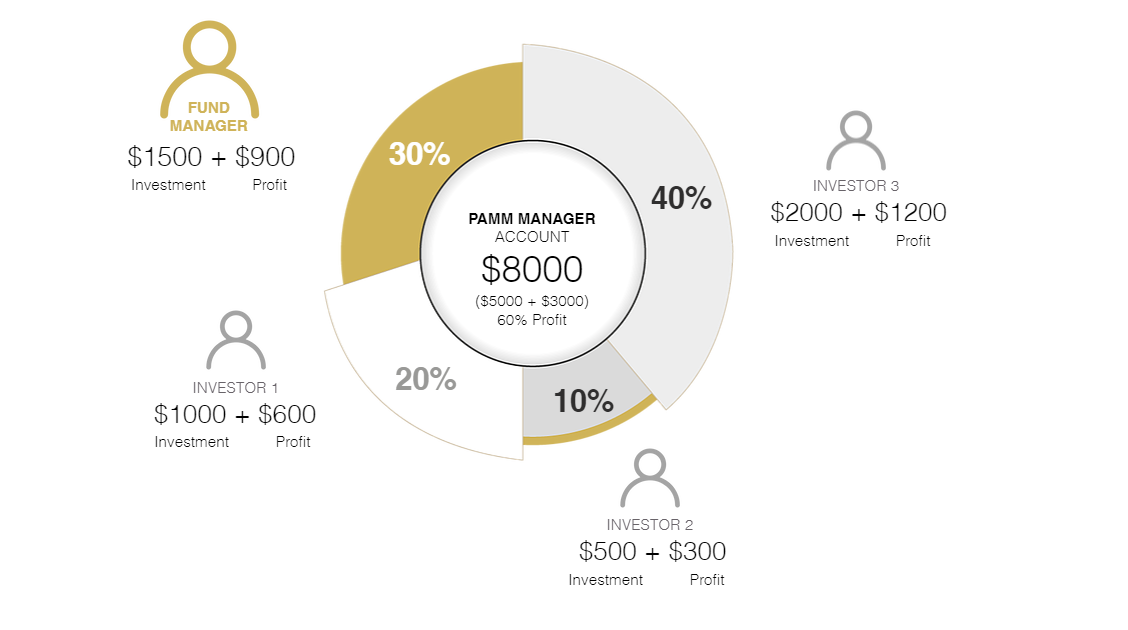

The FOREX account features a management module that distributes the sizes of trades according to an allocation percentage. This solution is offered by many forex brokers for investors and fund managers. With a FOREX account, an investor can also allocate a percentage of h is account to one or more managers.

We provide the FOREX/MAM investment package to our investor across the world. Our breadth of investment capabilities is extensive and among the most innovative within the Forex market. Our investors want rapid asset growth, but have a limited capacity to absorb downside risk. Risk is our scarce resource, to be deployed where it will earn the highest return.

Lucrative Investment opportunity at your fingertips.

Understanding How The Roubulls Forex Program Works

TAs a IQpickstrade FOREX investor, you open a IQpickstrade Capital Group FOREX Account and allocate funds to your investment Account – this is known as the Manager's Capital. When a FOREX Manager successfully manages investors' funds by generating a profit, the Manager and the investor(s) will receive a Success Fee – a pre-agreed percentage of the investor's share of the profit.

FOREX Managers trade using invested capital (Manager's Capital) and the funds of any investors in the account. Simply put, any profits and losses generated on the FOREX Manager's Account will be shared between all accounts that are invested in the FOREX Manager on a proportional basis.

Want To Become A IQpickstrade Forex Investor?

The IQpickstrade FOREX account Managers and Investors' capital are all invested in the Manager’s account. Their shares of the total investment and therefore their potential share of any profit/ losses are based on the amount of capital they invest. If a Manager is in profit when positions on the FOREX Manager account are closed and the account balance increases, the profit will be distributed between all Investors in the account based on their investments.

Open an Account